japan corporate tax rate 2022

Changes to the controlled foreign corporation CFC regime considering the corporate tax rate reduction in the United States. The current Japan VAT Value Added Tax is 500.

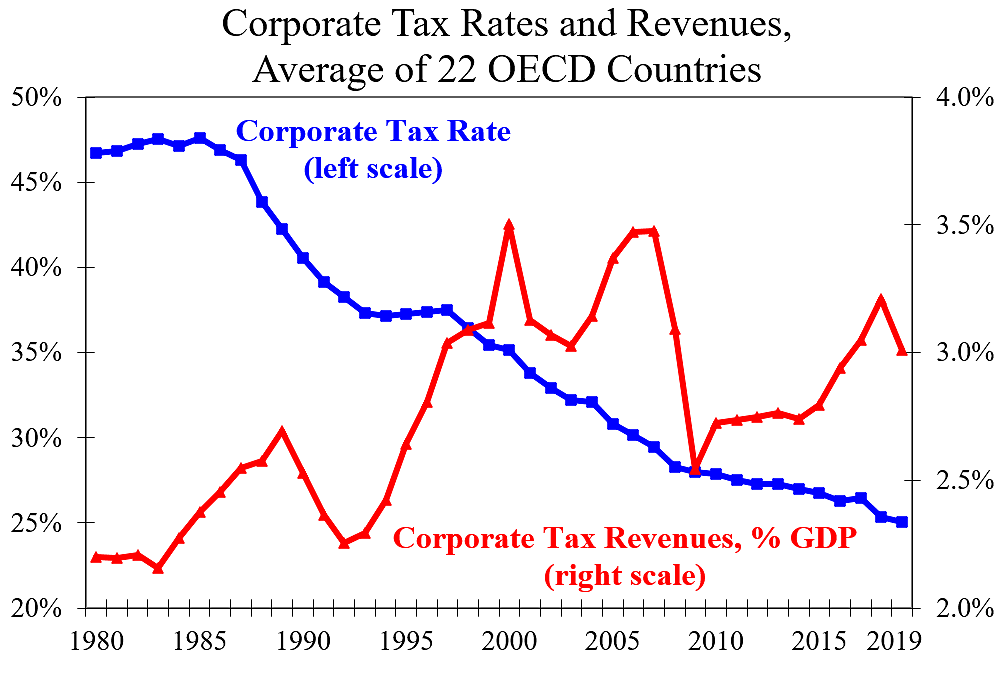

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Original due date of filing and payment.

. Monday 15 March 2021. Specified transactions such as sales. From April 2019 a 19 corporate tax rate is applied for companies which had average incomes larger than 15 billion JPY in the preceding 3 years.

NEW Due date of filing and payment. An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to 2583 percent by 2022. Puerto Rico follows at 375 and Suriname at 36.

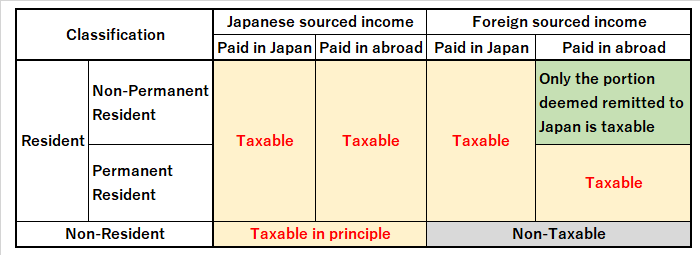

Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. As of 1 October 2019 the rate increased to 10. Income Tax Rates and Thresholds Annual Tax Rate.

Corporate Profits in Japan increased to 2301451 JPY Billion in the fourth quarter of 2021 from 1675083 JPY Billion in the third quarter of 2021. About 5 tax on a 100 purchase. It depends on companys scale location amount of taxable income rates of tax and the other.

The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy. Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. 216 rows Comoros has the highest corporate tax rate globally of 50.

Current Japan Corporate Tax Rate is 4740. The applicable rate is 8. United States 1300.

Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. In 2000 the average corporate tax rate was 326 percent and has decreased consistently to its current level of 213 percent. Dec 2014 Japan Corporate tax rate.

Based upon local rates applied in Tokyo. Fifteen countries do not have a general corporate income tax. VAT and Sales Tax Rates in Japan for 2022.

The tax rate has come down to 2997 today compared to 38 then. Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021.

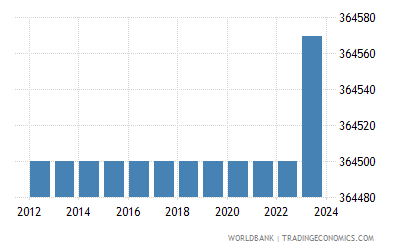

Thursday 15 April 2021. 7 rows Japan Income Tax Tables in 2022. Corporate Profits in Japan averaged 689426 JPY Billion from 1954 until 2021 reaching an all time high of 2640112 JPY Billion in the second quarter of 2018 and a record low of 4324 JPY Billion in the third quarter of 1954.

Exact tax amount may vary for different items. The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and international tax measures. Japan approved new carrot-and-stick tax measures to bring corporate taxes down to 25 for companies that raise wages by 3 and.

Japan Cuts Corporate Tax To Spur Growth Investments. Japan Corporate Tax Rate table by year historic and current data. The effective Japanese corporate income tax rate the total of the taxes listed above is presently 346 for companies with paid-in capital of JPY100000000 or less or 3062 for companies with paid-in capital greater than JPY100000000 including Japanese branch-offices of foreign companies with paid-in capital greater than JPY100000000 and subsidiaries of companies.

Exports and certain services to non-residents are taxed at a zero rate. 6 rows Corporate Tax Rate. Japan Prime Minister Shinzo Abe has been cutting corporate tax rates since taking office in 2012.

The National Tax Agency NTA of Japan has announced that the due date for 2020 tax return filing and tax payment will be extended to Thursday 15 April 2020 for the following three tax items. Excluding jurisdictions with corporate tax rates of 0 the countries with the lowest corporate tax rates are Barbados at 55 Uzbekistan at 75 and Turkmenistan at 8. In the long-term the Japan Corporate Tax Rate is projected to trend around 3062 percent in 2022 according to our econometric models.

Consumption tax value-added tax or VAT is levied when a business enterprise transfers goods provides services or imports goods into Japan. 2019-2020 State Income Tax Rates Sales Tax Rates and Tax Laws. Japan VAT Rate 500.

2022 Corporate Tax Rates in Europe Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022. Local management is not required. Japan 0130 BoJ Board Member Suzuki Speaks Forecast.

United States Corporate Tax Rate was 21 in 2022.

Corporate Tax Reform In The Wake Of The Pandemic Itep

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Corporation Tax Europe 2021 Statista

United Arab Emirates Corporate Tax Rate 2021 Data 2022 Forecast

Corporate Tax Reform In The Wake Of The Pandemic Itep

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Japan Land Area Sq Km 2022 Data 2023 Forecast 1961 2020 Historical

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Global Minimum Corporate Tax Rate Wikipedia

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

일본 법인 세율 1993 2021 데이터 2022 2024 예상